SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Securities Exchange Act of 1934

(Amendment (Amendment No. )

Plug Power Inc.

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| | ||||

![[MISSING IMAGE: lg_plugtm-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/lg_plugtm-4clr.jpg) Letter From Our Chief Executive Officer

| ||||

![[MISSING IMAGE: ph_andrewjmarsh-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/ph_andrewjmarsh-4clr.jpg) | |

| May 15, 2023 Dear Fellow Stockholder, For the last 25 years, Plug Power Our customers include some of the Our journey has been a remarkable one, and According to Bloomberg New Energy Finance, the global hydrogen economy could potentially become worth about $10 trillion by 2050, representing 18% of the global energy demand. Among pure-play hydrogen and fuel cell We expect that our hydrogen generation facilities will play a crucial role in the decarbonization of heavy industries, and we have plans to continue rapidly expanding hydrogen | |

| | | | | infrastructure. Our first green hydrogen plant in Georgia is expected to commence hydrogen production at the end of the second quarter of 2023. However, this is just the beginning — by 2025, we expect to produce approximately 500 tons of hydrogen per day in the United States. We are also constructing green hydrogen plants in Europe, including significant projects at the Port of Antwerp-Bruges, and establishing a green hydrogen platform for the Iberian Peninsula in collaboration with our partner Acciona in Spain. All our plants will employ Plug Power electrolyzers and Plug Power cryogenic equipment to produce and deliver liquid hydrogen using Plug Power trailers. Throughout the industry, Plug Power’s manufacturing remains a crucial differentiator, and Plug Power continues to bolster its supply chain capabilities through strategic partnerships. Our state-of-the-art facilities in Rochester and Albany, New York are unrivaled. Additionally, we have forged valuable partnerships with suppliers, such as Johnson Matthey, that grant us access to vital product development and manufacturing expertise, as well as essential metals that are crucial to scaling hydrogen infrastructure. At Plug Power, our strategy of scaling our manufacturing helps us significantly reduce our overhead expenses and lower our costs while increasing our margins. Over time, we believe this strategy will accelerate the We believe that our work over the past two years will bear fruit, delivering strong value for our stockholders. Today, Plug Power owns key elements of the broader hydrogen Until then, Plug Power remains committed to becoming the

economy. Thank you for your continued support of our company. Regards,

![[MISSING IMAGE: sg_andrewmarsh-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/sg_andrewmarsh-bw.jpg) Andrew J. Marsh | |

Latham, New YorkNY 12110

July 9, 2021

The Proxy Statement,statement, with the accompanying formal notice of the meeting, describes the matters expected to be acted upon at the Annual Meeting as well as information on how you can vote your shares and submit questions at the Annual Meeting. Only holders of record of Plug Power’s common stock at the close of business on June 16, 2021April 28, 2023 will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

![[MISSING IMAGE: sg_andrewmarsh-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/sg_andrewmarsh-bw.jpg)

President and Chief Executive Officer

Latham, New YorkNY 12110

(518) 782-7700

June 27, 2023

|

|

|

|

|

1. The election of two (2) Class III Directors, each to hold office until the Company’s 2026 Annual Meeting of Stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier resignation or removal; 2. The approval of an amendment to the Plug Power Inc. 2021 Stock Option and Incentive Plan, as amended, as described in this proxy statement; 3. The approval of the Plug Power Inc. 2023 Employee Stock Purchase Plan as described in this proxy statement; 4. The approval of the non-binding, advisory vote regarding the compensation of the Company’s named executive officers as described in this proxy statement; 5. The approval of the non-binding, advisory vote regarding the frequency of future non-binding, advisory votes to approve the compensation of the Company’s named executive officers; 6. The ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2023; and 7. Such other business as may properly come before |

In light of the COVID-19 pandemic, this year’s Annual Meeting will be held in a virtual-only meeting format. There will not be a physical meeting location, and stockholders will not be able to attend the Annual Meeting in person.

and any adjournments or postponements thereof.

See “

Can I change my vote or revoke my proxy?”June 27, 2023:

By Order of the Board of Directors

Gerard L. Conway, Jr.

Corporate Secretary

| | | | | By Order of the Board of Directors | |

| | | | | ![[MISSING IMAGE: sg_gerardlconwayjr-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/sg_gerardlconwayjr-bw.jpg) | |

| | | | | Gerard L. Conway, Jr. Corporate Secretary | |

July 9, 2021

May 15, 2023

| | ||||||||

| | | | 1 | | | |||

| | | | 9 | | | ||

| | ||||||||

| | | | 19 | | | |||

| | ||||||||

| | | | 32 | | | |||

| | | | 35 | | | ||

| ||||||||

| | | | 62 | | | ||

| | | | | 72 | | | |

| | | | | | 76 | | | |

| | | | | 78 | | | ||

| | | | 79 | | | ||

| | | | 82 | | | ||

| | | | 83 | | | ||

| | | | 85 | | | ||

| | | ||||||

| | 86 | | |

This proxy statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. You can identify forward-looking statements by words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” “estimate,” “predict,” “potential,” “continue,” or other similar expressions. Actual results may differ from those set forth in the forward-looking statements due to a variety of factors, including those contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and the Company’s other filings with the Securities and Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements, unless required by law.

968 Albany Shaker Road

Latham, New YorkNY 12110

(518) 782-7700

2021

June 27, 2023

THE PROXY MATERIALS, AND VOTING YOUR SHARES

|

|

|

|

|

1. The election of two (2) Class III Directors, each to hold office until the Company’s 2026 Annual Meeting of Stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier resignation or removal; 2. The approval of an amendment to the Plug Power Inc. 2021 Stock Option and Incentive Plan, as amended (the “Amended Plan”), as described in this proxy statement; 3. The approval of the Plug Power Inc. 2023 Employee Stock Purchase Plan (the “ESPP”) as described in this proxy statement; 4. The approval of the non-binding, advisory vote regarding the compensation of our named executive officers as described in this proxy statement; 5. The approval of the non-binding, advisory vote regarding the frequency of future non-binding, advisory votes to approve the compensation of our named executive officers; 6. The ratification of Deloitte & Touche LLP as our independent registered public accounting firm for 2023; and 7. Such other business as may properly come before |

Why is the 2021 Annual Meeting a virtual, online meeting?

In light of the COVID-19 pandemic, our Annual Meeting will be a virtual meeting of stockholders where stockholders will participate by accessing a website using the Internet. There will not be a physical meeting location. In light of the public health and safety concerns related to the COVID-19 outbreak, we believe that hosting a virtual meeting will facilitate stockholder attendance and participation at our Annual Meeting by enabling stockholders to safely participate from any location around the world. We have designed the virtual annual meeting to provide the same rights and opportunities to participate as stockholders have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform.

How can I attend the Annual Meeting?

We will be hosting our Annual Meeting via live webcast only. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/PLUG2021. The webcast will start at 10:00 a.m., Eastern Time, on July 30, 2021. Stockholders may vote and ask questions while attending the Annual Meeting online. In order to be able to attend the Annual Meeting, you will need the 16-digit control number, which is located on your proxy card. Instructions on how to participate in the Annual Meeting are also posted online at www.proxyvote.com.

any adjournments or postponements thereof.

Can I access As of the NoticeRecord Date, the Company had approximately 600,464,061 shares of Annual Meeting of Stockholders, this Proxy Statement and the 2021 Annual Report on 10-K on the Internet?

Yes, these materials are available on our website and can be accessed at www.proxyvote.com. The information found on, or accessible through, our websitecommon stock outstanding. Cumulative voting is not incorporated into, and does not form a partpermitted with respect to the election of this Proxy Statementdirectors or any other report or document we file with or furnishmatter to be considered at the Securities and Exchange Commission (the “SEC”).

Annual Meeting.

What is the required quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock entitled to voteupon at the Annual Meeting is necessary to constitute a quorum for the transaction of business atMeeting.

submit it with your vote.

Annual MeetingInternet Availability of Proxy Materials has been sent directly to you by us.

Board.

|

• By Telephone or Internet — All record holders can vote by touchtone telephone from the United States by dialing (800) 690-6903, or over the Internet at www.proxyvote.com. Please have your notice or proxy card, which will contain your voter control number, |

|

|

Stockholders that own stock in “streethand when voting. “Street name” must demonstrate proof of beneficial ownership to virtually attend the meeting and must obtain a legal proxy fromholders may vote by telephone or Internet if their bank, broker or other nominee to vote atmakes those methods available, in which case the meeting.

Your bank, broker or other nominee will provideenclose the instructions with the Notice of Internet Availability of Proxy Materials they send you. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to vote their shares, and to confirm that their instructions have been recorded properly.

without a nominee issued proxy. Note that a broker letter that identifies you as a stockholder is not the same as a nominee issued proxy.

discretion.

such broker, bank or nominee.

With respect to Proposal 5 (approval of a non-binding, advisory vote regarding the frequency of future non-binding, advisory votes regarding the compensation of the Company’s named executive officers), stockholders may vote for a frequency of one year, two years, or three years, or abstain from voting on the proposal.

Plan as described in this proxy statement;

ESPP as described in this proxy statement;

What if I do not specify how I want my shares voted?

Proposal 1 – FOR the election of each of the three nominees ofset forth above under “

Proposal 2 – FOR the approval of the Fifth Certificate of amendment of the Amended and Restated Certificate of Incorporation of the Company;

Proposal 3 – FOR the approval of the Plug Power Inc. 2021 Stock Option and Incentive Plan;

Proposal 4 – FOR the approval of the non-binding advisory resolution regarding the compensation of the Company’s named executive officers; and

Proposal 5 – FOR the ratification of KPMG LLP as the Company’s independent auditors for 2021.

should vote my shares?

”•

Virtually attending the Annual Meeting, without voting online during the Annual Meeting, will not revoke your prior Internet vote, telephone vote or proxy submitted by mail, as the case may be.

How are votes withheld from director nominees, abstentions and broker non-votes treated?

Abstentions

Under the engagement agreement with Mackenzie Partners, Inc., we will indemnify and hold MacKenzie Partners, Inc. and all of its directors, officers, employees and agents harmless against all claims, expenses, losses, damages, liabilities and/or judgments of any kind whatsoever that arise out of or relate to the advisory, consulting and proxy solicitation services under the agreement (the “Losses”), except for any Losses that are held in a final judicial decision by a court of competent jurisdiction from which no right of appeal exists to have resulted from willful misconduct or bad faith on the part of MacKenzie Partners, Inc.

the Company’s common stock.

you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a Notice of the Annual Meetingnotice for shares held in your name and a notice or voting instruction card for shares held in “street name.” Please follow the directions provided in the notice for the Annual Meetingcomplete, sign, date, and return each additional notice orproxy card and voting instruction card that you receive in order to ensure thatcast your vote with respect to all of your sharesshares.

available at www.proxyvote.com. Stockholders can elect to receive paper copies in the mail by visiting www.plugpower.com, by writing to Investor Relations at Plug Power Inc., 968 Albany Shaker Road, Latham, New York 12110 or by contacting the Company at (518) 782-7700.

A

III Director. Mr. Silver and Dr. Song are currently members of our Board and each has been nominated for re-election to serve as a Class III Director.

| Jonathan M. Silver | | |||

Age: 65 Director since 2018 Board Committee: Corporate Governance and Nominating; Regulatory Affairs Class III Director: Continuing in Office until the 2023 Annual Meeting | | | Jonathan M. Silver has served as a director of the Company since June 2018 Mr. Silver is a Senior Advisor and Chair, Global Climate Council, at Apollo Global Management, a $550 billion asset manager. At Apollo, he Chairs the firm’s Global Climate Council, the group which supports and guides the firm’s $50 billion investment program in sustainability-related entities. Earlier, he was a Senior Advisor at Guggenheim Partners, a large asset manager and investment bank, where he helped expand the firm’s activities in sustainability. From 2015 to 2019, Mr. Silver served as the Managing Partner of Tax Equity Advisors LLC, an advisory firm managing investments in solar power projects on behalf of large corporations. From 2011 to 2018, he also served as Senior Advisor to a number of clean energy firms, including ICF International, Inc., an energy and environmental consulting firms, NextEra Energy, Inc., the nation’s largest renewable energy provider, and Marathon Capital, LLC, a power industry-focused investment bank. He currently sits on the boards of National Grid (NGG: NSYE), a global utility, EG Acqusition Corporation, and Intellihot Inc., a leading player in the tankless water heating sector. Earlier, he served on the boards of Peridot Acquisition Corp, which merged with Li-Cyle, a leader in battery recycling, Eemax, Inc. and Sol Systems, LLC. From 1999 to 2008, Mr. Silver was the co-founder of Core Capital Partners, a venture capital investor in battery technology, advanced manufacturing, telecommunications and software. From 1990 to 1992, he was a Managing Director, and the Chief Operating Officer of Tiger Management, one of the country’s largest and most successful hedge funds. He has also held senior operating positions, including chief operating officer and executive vice president, in several companies. Mr. Silver began his career in | |

| Jonathan M. Silver | | |||

| | | | 1982 at McKinsey and Company, a global management consulting firm, working on strategic issues for some of the nation’s largest financial institutions and corporations. Mr. Silver has served as a senior advisor to three U.S. Cabinet Secretaries: Commerce (1992 to 1993), Treasury (1992 to 1994) and Interior (1993 to 1995). He is on the board of Resources for the Future and has been on the boards of the American Federation of Scientists, the Wind Energy Foundation and American Forests. We believe Mr. Silver’s qualifications to sit on our Board include his extensive experience with the alternative energy industry, his high-level experience in government and in energy policy and his deep experience as an investor in and advisor to, both clean energy and clean tech companies and their investors. | |

| Kyungyeol Song | | |||

Age: 50 Director since 2021 Board Committee: Merger & Acquisition / Strategy Class III Director: Continuing in Office until the 2023 Annual Meeting | | | Kyungyeol Song has been a director of the Company since February 2021. Dr. Song is an Executive Vice President of SK E&S Co., Ltd. (“SK”) and the Chief Operating Officer at PassKey, Inc., a US-based energy transition business entity of SK. Prior to his current position, Dr. Song served as the Senior Vice President in Energy Solution TF at SK Group Supex Council from February 2019 until August 2020 and was the Head of Quantum Growth TF at SK until 2022. Dr. Song also served as the Director of the McKinsey Energy Center from February 2007 until December 2018. Dr. Song received a Ph.D. in Control and Estimation Theory, Aeronautics and Astronautics from the Massachusetts Institute of Technology, a Master of Science in Aerospace Engineering from Seoul National University, and a Bachelor of Science degree in Aerospace Engineering from Seoul National University. Dr. Song was appointed to the Board by Grove Energy Capital LLC, a stockholder of the Company, pursuant to the Investor Agreement, dated as of February 24, 2021. We believe Dr. Song’s qualifications to sit on our Board include his extensive experience with the renewable energy industry. | |

Andrew J. Marsh | | ||||

Age: 67 Director since 2008 Board Committee: None | | | Andrew J. Marsh joined the Company as President and Chief Executive Officer in April 2008 and has been our director since 2008. As President and Chief Executive Officer, Mr. Marsh plans and directs all aspects of the organization’s policies and objectives, and is focused on building a company that leverages Plug Power’s combination of technological expertise, talented people and focus on sales growth to continue the Company’s leadership stance in the future alternative | | |

| Andrew J. Marsh | | |||

| Class I Director: Continuing in Office until the 2024 Annual Meeting | | | energy economy. Mr. Marsh continues to spearhead hydrogen fuel cell innovations, and his ability to drive revenue growth landed Plug Power on Deloitte’s Technology Fast | |

| board of directors of Gevo, Inc., a publicly traded renewable chemicals and advanced biofuels company. Previously, Mr. Marsh was a co-founder of Valere Power, where he served as chief executive officer and board member from the company’s inception in 2001, through its sale to Eltek ASA in 2007. Under his leadership, Valere grew into a profitable global operation with over 200 employees and $90 million in revenue derived from the sale of DC power products to the telecommunications sector. During Mr. Marsh’s tenure, Valere Power received many awards such as the Tech Titan award as the fastest growing technology company in the Dallas Fort Worth area and the Red Herring Top 100 Innovator Award. Prior to founding Valere, he spent almost 18 years with Lucent Bell Laboratories in a variety of sales and technical management positions. | |||

Mr. Marsh is a prominent voice leading the hydrogen and fuel cell industry. Nationally, he is the Chairman of the Fuel Cell and Hydrogen Energy Association, and | ||||

| Southern Methodist University. We believe Mr. Marsh’s qualifications to sit on our Board include his extensive experience with the alternative energy industry, as well as his experience in management positions. | | |||

| |||||

|

| ||||

Maureen O. Helmer | | |||

Age: 66 Director since 2004 Board Committees:

| | | Maureen O. Helmer has been a director of the Company since 2004. Ms. Helmer | |

| Maureen O. Helmer | | |||

Corporate Governance and Nominating (Chair); Regulatory Affairs Class I Director: Continuing in Office until the 2024 Annual Meeting | | | industrial companies on policy and government affairs issues. In addition to serving as Chair of the New York State Public Service Commission (“PSC”) from 1998 to 2003, Ms. Helmer also served as Chair of the New York State Board on Electric Generation Siting and the Environment. Prior to her appointment as Chair, Ms. Helmer served as Commissioner of the PSC from 1997 until 1998 and was General Counsel to PSC from 1995 through 1997. From 1984 through 1995, Ms. Helmer held several positions in the New York Legislature, including Counsel to the Senate Energy Committee. She also served as a board member of the New York State Energy Research and Development Authority, the New York State Environmental Board and the New York State Disaster Preparedness Commission during her tenure as Chair of the | |

We believe Ms. Helmer’s qualifications to sit on our Board include her long history of experience with energy regulation, policy and government affairs and advising energy and industrial companies. | | |||

| Kavita Mahtani | | |||

Age: 52 Director since 2022 Board Committees: Audit Class I Director: Continuing in Office until the 2024 Annual Meeting | | | Kavita Mahtani is Chief Financial Officer, Americas for London-headquartered HSBC. Based in New York, Ms. Mahtani manages a finance organization across the U.S., Canada, Mexico, and South America. In her role, Ms. Mahtani drives growth and M&A strategy, as well as restructuring and re-engineering efforts alongside the Chief Executive Officer. Prior to joining HSBC, Ms. Mahtani served in several leadership roles during her 13-year tenure with Citigroup, Inc., including Managing Director — Global Head of Asset and Liability Management, Chief Financial Officer, Global Corporate and Investment Banking, and Managing Director — Global Head of Financial Planning and Analysis, among others. Ms. Mahtani has also held roles with Morgan Stanley and Merrill Lynch & Company, Inc. Ms. Mahtani holds a Bachelor of Science degree in Economics from the University of Pennsylvania, The Wharton School, and a Master of Business Administration from the University of Chicago’s Graduate School of Business. | |

| Kavita Mahtani | | |||

| | | | We believe Ms. Mahtani’s qualifications to sit on our Board include extensive experience with growth strategies, merger and acquisition implementation, and leadership. | |

| Gary K. Willis | | |||

Age: 77 Director since 2003 Board Committees: Audit; Compensation (Chair); Regulatory Affairs; Merger & Acquisition / Strategy Class I Director: Continuing in Office until the 2024 Annual Meeting | | | Gary K. Willis has been a director of the Company since 2003. Mr. Willis previously served as the President of the Zygo Corporation (“Zygo”) from February 1992 to 1999 and the Chief Executive Officer from 1993 to 1999. Mr. Willis served as a director of Zygo from 1992 to November 2000, including as Chairman of the board from 1998 to 2000. Mr. Willis also served as a director of Zygo from 2004 to 2014. Zygo, which was acquired in 2014 by Ametek, Inc., was a provider of metrology, optics, optical assembly, and systems solutions to the semiconductor, optical manufacturing, and industrial/automotive markets. Prior to joining Zygo, Mr. Willis served as the President and Chief Executive Officer of The Foxboro Company, a manufacturer of process control instruments and systems. Mr. Willis holds a Bachelor of Science degree in Mechanical Engineering from Worcester Polytechnic Institute. We believe Mr. Willis’ qualifications to sit on our Board include his extensive experience in management and director positions with similar companies, as well as his educational background in mechanical engineering. | |

| Jean A. Bua | | ||||

| |||||

Age: 64 Director since 2022 Board Committee: Audit (Chair) Class II Director: Continuing in

| | | Jean A. Bua currently is the Executive Vice President, Chief Financial Officer, Chief Accounting Officer and Treasurer of NetScout Systems, Inc. (NASDAQ: NTCT), a provider of real-time operational intelligence and performance analytics for service assurance and cyber security solutions. Prior to NetScout, Ms. Bua served as Executive Vice President, Finance & Treasurer of American Tower Corporation, an operator of wireless and broadcast communications infrastructure, and spent nine years at Iron Mountain, Inc., an information management services company, concluding as Senior Vice President, Chief Accounting Officer and Worldwide Controller. She also previously held senior positions at Duracraft Corp. and Keithley Instruments and was a management consultant at Ernst & Young LLP and an auditor at KPMG LLP. She has led all global financial operations, including M&A analysis, acquisition integration, capital market strategy, financial planning and analysis, international tax, financial systems and compliance for high-growth, transformative public companies. Ms. Bua served as a board member and audit committee chair for Coresite Realty until its acquisition at the end of | | |

| Jean A. Bua | | |||

| | | | 2021. Ms. Bua earned a Bachelor of Science in Business Administration, summa cum laude, from Bryant College and an M.B.A. from the University of Rhode Island. We believe Ms. Bua’s qualifications to sit on our Board include her knowledge of acquisition strategy and implementation, global financial operations, and compliance. | |

| Gregory L. Kenausis | | |||

Age: 53 Director since 2013 Board Committee: Audit; Compensation; Merger & Acquisition / Strategy Class II Director: Continuing in Office until the 2025 Annual Meeting | | | Gregory L. Kenausis has been a director of the Company since October 2013. Dr. Kenausis is the founding partner and since 2005 has been the Chief Investment Officer of Grand Haven Capital AG, an investment firm, where he is the head of research and trading activity and is responsible for managing the fund’s operations and structure. He also has worked extensively as a business consultant with a focus on business development and strategy, as well as valuation. Dr. Kenausis earned a bachelor’s degree from Yale University and a doctoral degree from the University of Texas at Austin. We believe Dr. Kenausis’ qualifications to sit on our Board include his background and senior level experience in financial investments, business development and strategy, management and equity capital markets. | |

| George C. McNamee | | |||

Chairman Age: 76 Director since 1997 Board Committee: Compensation; Regulatory Affairs; Merger & Acquisition / Strategy Class II Director: Continuing in Office until the | | | George C. McNamee serves as Chairman of the Company’s Board of Directors and has served as such since 1997. He was previously Chairman of First Albany Companies Inc. | |

| George C. McNamee | | |||

| 2025 Annual Meeting | | | Service Award. He served as a NYSE director from 1999 to 2004 and chaired its foundation. In the aftermath of the 1987 stock market crash, he chaired the Group of Thirty Committee to reform the Clearance and Settlement System. Mr. McNamee has been active as a director or trustee of civic organizations including The Albany Academies and Albany Medical Center, whose Finance Committee he chaired for 12 years. He is also a director of several private companies, a Sterling Fellow of Yale University and a Trustee of The American Friends of Eton College. He conceived and co-authored a book on the Chicago Conspiracy Trial. He received his Bachelor of Arts degree from Yale University. We believe Mr. McNamee’s qualifications to sit on our Board include his experience serving on technology company boards, his background in investment banking, which has given him broad exposure to many financing and merger and acquisition issues, and experience with the financial sector and its regulatory bodies. | |

| ||

|

| |

| ||

|

| |

| ||

Class III Directors

| ||

|

| |

| ||

|

| |

| ||

|

| |

| ||

|

| |

The Board of Directors has determined that Messes. Bua, Helmer and Harriman, Dr.Mahtani, Drs. Kenausis Dr.and Song and Messrs. McNamee, Willis,Schneider, Silver Roth and SchneiderWillis are independent directors as defined in Rule 5605(a)(2) under the Marketplace Rules of the National Association of Securities Dealers, Inc. (the “NASDAQ“Nasdaq Rules”).

Investor Agreement

.

The positions

tenure on the Board. Longer-serving directors bring valuable experience and a deep understanding of our complex business and industry, along with a historical perspective of our long-term successes, challenges and business cycles, and how these past experiences may inform our current strategy. Newer directors are also critical to the advancement of our strategy, bringing new skills and experiences and contributing fresh perspectives. Over the past year, the Board has been keenly focused on the recruitment of exceptional director candidates to replace departing directors. The Board focused on director candidates whose skills and experience no only enhanced the Board but also made them highly qualified to serve on our Audit Committee.

The Chief Financial Officermatters, including compliance with applicable federal securities laws. Additionally, in January 2023, the Board established two additional standing Board committees: the Merger & Acquisition / Strategy Committee and the General Counsel reportRegulatory Affairs Committee. The Regulatory Affairs Committee is responsible for the oversight of the Company’s compliance programs and activities to help ensure the Company complies with all laws, rules and regulations applicable to the Company and its operations, and the Merger & Acquisition / Strategy Committee is responsible for assisting the Board in fulfilling its oversight responsibilities relating to the Company’s long-term strategy, risks and opportunities relating to such strategy, and strategic decisions regarding ongoing risk management activities atacquisitions, investments, joint ventures and divestitures by the regularly scheduled, quarterlyCompany.

| Board Diversity Matrix (As of April 17, 2023) | | ||||||||||||||||||

| Total Number of Directors | | | 10 | | |||||||||||||||

| | | | Female | | | Male | | | Did Not Disclose Gender | | |||||||||

| Part I: Gender Identity | | ||||||||||||||||||

| Directors | | | | | 3 | | | | | | 6 | | | | | | 1 | | |

| Part II: Demographic Background | | ||||||||||||||||||

| Asian | | | | | 1 | | | | | | 1 | | | | | | | | |

| White | | | | | 1 | | | | | | 5 | | | | | | | | |

| Did Not Disclose Demographic Background | | | | | | | | | | | 2 | | | | | | | | |

On January 18, 2023, the Board established two additional standing Board committees: the Merger & Acquisition / Strategy Committee and the Regulatory Affairs Committee.

2022.

proxy statement.

•

The Audit Committee reviewed and discussed with management of the Company and KPMGDeloitte & Touche LLP the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2020,2022, including management’s assessment of the effectiveness of the Company’s internal controls over financial reporting as of December 31, 2020.

On March 16, 2021, the Company and the Audit Committee concluded that, because of errors identified in the Company’s previously issued financial statements, the Company’s audited consolidated financial statements as of and for the years ended December 31, 2019 and 2018 and its unaudited quarterly consolidated financial statements as of and for each of the quarterly periods ended March 31, 2020 and 2019, June 30, 2020 and 2019, September 30, 2020 and 2019 and December 31, 2019 were restated. These errors were identified after the Company reported its 2020 fourth quarter and year end results on February 25, 2021. The Company determined that these errors were the result of a material weakness in internal control over financial reporting which are described in Part II, Item 9A, “Controls and Procedures” in the Annual Report on Form 10-K for the year ended December 31, 2020 (the “Form 10-K”).

Management performed an assessment of the effectiveness of our internal control over financial reporting and concluded that our internal control over financial reporting was not effective as of December 31, 2020. Management identified the following deficiency in internal control over financial reporting as of December 31, 2020: the Company did not maintain a sufficient complement of trained, knowledgeable resources to execute its responsibilities with respect to internal control over financial reporting for certain financial statement accounts and disclosures. As a consequence, the Company did not conduct an effective risk assessment process that was responsive to changes in the Company’s operating environment and did not design and implement effective process-level controls activities in the following areas:

|

|

|

|

As reported in the Form 10-K and the Form 10-Q for the quarter ended March 31, 2021, the Company continues to take steps to remediate this material weakness and will continue to take further steps until such remediation is complete. These steps include the following:

|

|

|

|

The Company also intends to deploy new tools and tracking mechanisms to help enhance and maintain the appropriate documentation surrounding its classification of operating expenses.

The Company will report regularly to the Audit Committee on the progress and results of the remediation plan, including the identification, status, and resolution of internal control deficiencies.

As the Company works to improve its internal control over financial reporting, the Company may modify its remediation plan and may implement additional measures as it continues to review, optimize and enhance its financial reporting controls and procedures in the ordinary course. The material weakness will not be considered remediated until the remediated controls have been operating for a sufficient period of time and can be evidenced through testing that they are operating effectively. The material weakness has not been remediated as of March 31, 2021. For more information about the restatement, including impacts on the Company’s financial statements, and the Company’s remediation plan, see the Form 10-K that is available at www.proxyvote.com.

Additionally, the Audit Committee has discussed with KPMGDeloitte & Touche LLP other matters required to be discussed under professional standards. The Audit Committee has also discussed related party transactions, the critical accounting policies used in the preparation of the Company’s annual consolidated financial statements, alternative treatments of financial information within GAAPU.S. generally accepted accounting principles (“GAAP’) that KPMGDeloitte & Touche LLP discussed with management, if any, and the ramifications of using such alternative treatments and other written communications between KPMGDeloitte & Touche LLP and management.

KPMG

Gregory L. Kenausis

Kimberly A. Harriman

Maureen O. Helmer

Kavita Mahtani

Gary K. Willis

| 2020 | 2019 | |||||||

Audit Fees | $ | 3,911,900 | $ | 1,064,325 | ||||

Audit-Related Fees | $ | 30,000 | $ | 30,000 | ||||

Tax Fees | — | — | ||||||

All Other Fees | — | — | ||||||

|

|

|

| |||||

Total | $ | 3,941,900 | $ | 1,094,325 | ||||

fiscal year ended December 31, 2022:

| | | | 2022 | | | 2021 | | ||||||

| Audit Fees | | | | $ | 4,201,429 | | | | | $ | 3,945,000 | | |

| Audit-Related Fees | | | | $ | 94,000 | | | | | $ | 35,000 | | |

| Tax Fees | | | | $ | 492,819 | | | | | | — | | |

| All Other Fees | | | | | — | | | | | | — | | |

| Total | | | | $ | 4,788,248 | | | | | $ | 3,980,000 | | |

consolidated financial statements; (3) “tax fees” are fees for tax compliance, tax advice, and tax planning; and (4) “all other fees” are fees for any services not included in the first three categories.

until the appointment of Deloitte & Touche LLP and pre-approved all audit and audit-related services provided to the Company by Deloitte & Touche LLP for the fiscal year ended December 31, 2022.

proxy statement.

proxy statement.

proxy statement.

to the ethical conduct of our business and our long-standing commitment to honesty, fair dealing and full compliance with all laws affecting our business. In the event that we amend or waive certain provisions of our code of conduct in a manner that requires disclosure under applicable rules, we intend to provide such required disclosure on our website in accordance with applicable SEC and NASDAQNasdaq Rules. Our code of ethics is available on our website at www.plugpower.com under the Investor Relations.Relations section. Our website is not incorporated into or a part of this Proxy Statement.

proxy statement.

During 2020, pursuant

During 2020, under the Plan, each non-employee director was paid an annual retainer of $40,000 ($85,000 for any non-employee Chairman) for his or her services. Committee members received additional annual retainers for their service on committees of the Board in accordance with the following table:

Committee | Chairman ($) | Member ($) | ||||||

Audit Committee | 20,000 | 15,000 | ||||||

Compensation Committee | 15,000 | 5,000 | ||||||

Corporate Governance and Nominating Committee | 10,000 | 5,000 | ||||||

These additional payments for service on a committee are due to the workload and broad-based responsibilities of the committees. The total amount of the annual retainer is paid in a combination of 50% cash and 50% Common Stock, provided that the director may elect to receive a greater portion (up to 100%) of the total retainer in Common Stock. All Common Stock issued for the annual retainers is fully vested at the time of issuance and is valued at its fair market value on the date of issuance. Non-employee directors are also reimbursed for their direct expenses associated with their attendance at Board meetings.

The Compensation Committee regularly reviews non-employee director compensation in comparison to our industry peer group, and considers growth in our market capitalization and sales, and other relevant factors including periodic independent market assessments. The Plan was amended by the Board in September 2020, effective as of January 1, 2021, to provide for (i) an increase in the annual retainer payable for service on the Board, and (ii) an increase in the value of the stock option and restricted stock awards granted to non-employee

directors upon initial election to the Board and annually. The adjustments to the annual retainer and equity grants were designed to be competitive with our 2020 peer group.

Effective January 1, 2021, pursuant to the Plan, upon initial election or appointment to the Board, each non-employee director (other than Dr. Song) will receivereceives an initial, one-time award of a non-qualified stock option to purchase a number of shares equal to $225,000 divided by the closing price of our Common Stockcommon stock on the grant date, with an exercise price equal to the fair market value of our Common Stockcommon stock on the grant date and that becomes fully vested and exercisablevests in full on the first anniversary of the grant date, subject to continued service through such date. EachThe initial award expires ten (10) years from the grant date. Notwithstanding the foregoing, all shares of our common stock subject to such non-qualified stock option will become fully vested and exercisable subject to the non-employee director’s continued service relationship through the consummation of a “sale event,” as defined in the 2021 Plan, immediately prior to the consummation of such sale event. In addition, pursuant to the Director Compensation Plan, each year of a non-employee director’s tenure, thea director (other than Dr. Song) will receiveSong and any director receiving an initial award upon initial election or appointment to the Board) receives an equity grant comprised of (i) a non-qualified stock option forto purchase a number of shares equal to $112,500 divided by the closing price of our Common Stockcommon stock on the date of the grant and (ii) a number of shares of restricted Common Stockcommon stock equal to $112,500 divided by the closing price of our Common Stockcommon stock on the grant date. The stock option portion of the grant will haveexpires ten (10) years from the grant date and has an exercise price equal to the fair market value of our Common Stockcommon stock on the grant datedate. The stock option and become fully vested and exercisable onrestricted common stock vest in full upon the earlier of the first anniversary of the grant date or the date of the next annual meeting which is at least fifty (50) weeks after the immediately preceding year’s annual meeting, subject to continued service through such date. TheNotwithstanding the foregoing, all such shares of restricted Common Stock grantcommon stock and stock options will become fully vested, onsubject to the first anniversarynon-employee director’s continued service relationship through the consummation of a sale event, immediately prior to the grant date.

Effective January 1, 2021, underconsummation of such sale event.

Committee | Chairman ($) | Member ($) | ||||||

Audit Committee | 20,000 | 15,000 | ||||||

Compensation Committee | 15,000 | 5,000 | ||||||

Corporate Governance and Nominating Committee | 10,000 | 5,000 | ||||||

| Committees | | | Chair ($) | | | Member ($) | | ||||||

| Audit Committee | | | | | 20,000 | | | | | | 15,000 | | |

| Compensation Committee | | | | | 15,000 | | | | | | 5,000 | | |

| Corporate Governance and Nominating Committee | | | | | 10,000 | | | | | | 5,000 | | |

| Committees | | | Chair ($) | | | Member ($) | | ||||||

| Audit Committee | | | | | 25,000 | | | | | | 20,000 | | |

| Compensation Committee | | | | | 20,000 | | | | | | 10,000 | | |

| Corporate Governance and Nominating Committee | | | | | 15,000 | | | | | | 10,000 | | |

| Merger & Acquisition / Strategy Committee | | | | | 15,000 | | | | | | 10,000 | | |

| Regulatory Affairs Committee | | | | | 15,000 | | | | | | 10,000 | | |

Name | Fees Earned or Paid in Cash(1)($) | Stock Awards(2) ($) | Option Awards(3) ($) | Total($) | ||||||||||||

Gary K. Willis | 70,000 | 62,500 | 36,145 | 168,645 | ||||||||||||

George C. McNamee | 90,000 | 62,500 | 36,145 | 188,645 | ||||||||||||

Gregory L. Kenausis | 60,000 | 62,500 | 36,145 | 158,645 | ||||||||||||

Johannes M. Roth | 50,000 | 62,500 | 36,145 | 148,645 | ||||||||||||

Maureen O. Helmer | 65,000 | 62,500 | 36,145 | 163,645 | ||||||||||||

Jonathan Silver | 45,000 | 62,500 | 36,145 | 143,645 | ||||||||||||

Lucas P. Schneider | 45,000 | 62,500 | 36,145 | 143,645 | ||||||||||||

|

| Name | | | Fees Earned or Paid in Cash(1)($) | | | Stock Awards(2) ($) | | | Option Awards(3) ($) | | | Total($) | | ||||||||||||

| Jean A. Bua | | | | | 57,144 | | | | | | 112,494 | | | | | | 71,692 | | | | | | 241,330 | | |

| Maureen O. Helmer | | | | | 85,000 | | | | | | 112,494 | | | | | | 71,692 | | | | | | 269,186 | | |

| Gregory L. Kenausis | | | | | 76,430 | | | | | | 112,494 | | | | | | 71,692 | | | | | | 260,616 | | |

| Kavita Mahtani | | | | | 53,572 | | | | | | 112,494 | | | | | | 71,692 | | | | | | 237,758 | | |

| George C. McNamee | | | | | 130,000 | | | | | | 112,494 | | | | | | 71,692 | | | | | | 314,186 | | |

| Lucas P. Schneider | | | | | 65,000 | | | | | | 112,494 | | | | | | 71,692 | | | | | | 249,186 | | |

| Jonathan M. Silver | | | | | 65,000 | | | | | | 112,494 | | | | | | 71,692 | | | | | | 249,186 | | |

Kyungyeol Song(4) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| Gary K. Willis | | | | | 90,000 | | | | | | 112,494 | | | | | | 71,692 | | | | | | 274,186 | | |

|

|

Meeting, with the exception of Jean A. Bua.

the name and address of recordFor a discussion of the stockholder;

a representation that the securityholder is a record holder of the Company’s stock entitled to vote in the election of directors, or if the securityholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”);

the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employmentrequirements for the preceding five (5) full fiscal yearssubmission of the proposedstockholder proposals or director candidate;

a description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications and other criteria for membership on the Board approved by the Corporate Governance and Nominating Committee from time to time;

a description of all arrangements or understandings between the securityholder and the proposed director candidate;

the consent of the proposed director candidate (i) to be named in the proxy statement relating to the annual meeting of stockholders and (ii) to serve as a director if elected at such annual meeting; and

any other information regarding the proposed director candidate that is required to be included in a proxy statement filed pursuant to the rules of the SEC.

Board Membership Criteria

•

•

Nominating Committee will primarily apply the criteria set forth in our Corporate Governance Guidelines.corporate governance guidelines. These criteria include the candidate’s integrity, business acumen, age, experience, commitment, diligence, conflicts of interest, and the ability to act in the interests of all shareholders.stockholders. Our Guidelinescorporate governance guidelines specify that the value of diversity on the Board should be considered by the Corporate Governance and Nominating Committee in the director identification and nomination process. The Corporate Governance and Nominating Committee seeks nominees with a broad diversity of experience, professions, skills, geographic representation, and backgrounds. The Corporate Governance and Nominating Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The Company believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge, and abilities that will allow the Board to fulfill its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability, or any other basis proscribedprotected by law. For a more comprehensive discussion of our Corporate Governance and Nominating Committee’s current policy with regard to the consideration of director candidates, please refer to “Policies“Policies Governing Director Nominations.”

People

Weelectrolyzers that help global customers adopt green hydrogen, to developing end-to-end green hydrogen solutions, we believe our hydrogen solution ecosystem will help the economy transition from one that is fossil fuel-driven to one that is better for a livable planet. Our commitment to the environment is reflected not only through the impacts of our products in making a positive impact inoperation but to our commitment to resource efficiency, responsible design, materials management, and recycling. This year, we plan to track greenhouse gas emissions, and have agreed to add electric vehicles to our fleet, both of which will help us cut our own emissions as we scale our green hydrogen business. Our mission is to consistently increase our supply chain responsibility and manage our products at the communities where we live and work. From organizations dedicated to health, housing and development and children and families in need — we strive to empower the local community through philanthropic efforts. We also encourage our employees to donate to charitable organizationsend of their choice.

Education

We are active in educational engagementlifecycles so that we can displace diesel and seekother fossil fuels with the accelerated use of green hydrogen as we transition to broaden the educational opportunities of students in our communities who demonstrate a passion for scienceglobal net-zero economy.

Sustainability

Inclusion

Diversity and Inclusion

We invest in the long-term development and engagement of our employees by aspiring to have an increasingly diverse workforce, inclusive environment, training and development programs and a culture where our people can thrive. We are committed to providing and supporting a work environment that promotes equality of opportunity among our employees.productive workplace free from discrimination or harassment. We strive for our workforce to be truly representative of all sections of society and for each employee to feel respected and able to perform at his or her best. In the United States, 23.6%as of December 31, 2022, 32.8% of our employeeworkforce population iswas considered diverse and 14.9%17.03% was female.

Environmental, further enhanced by policies related to various aspects of employment, including, but not limited to, recruiting, hiring, job assignment, compensation, access to benefits, selection for training, use of facilities, and participation in Company-sponsored employee activities.

As a leader in innovative solutions and services that drive technology advancements in the fuel cell industry, Plug Power is committed to responsible business — for our people and for the environment. This responsibility extends from our operations, to our diverse eco-system of partners, and to our customers. We are committed to continued integration and improvement of environmental, health and safety (EHS) management practices into our business.

To demonstrate our commitment, Plug Power strives to:

Care for our people and the environment by considering design for EHS principles from a life cycle perspective, in our product design and development, operations and supply chain;

Protect our employees, community, and the environment by committing to pollution prevention, as well as to creating an injury-free workplace and safety-based culture. We promote a healthy lifestyle and encourage employee health and wellness and work-life balance;

Engage suppliers to advance sustainability efforts;

Comply with applicable EHS legal and other customer requirements. We also engage with our stakeholders to understand their needs and expectations;

Set goals and objectives to address the most significant EHS impacts and risks resulting from our business operations, services and products; and

Regularly monitor and evaluate our EHS performance results to demonstrate continual improvement.

Plug Power leadership has developed and endorses this EHS Policy. In this capacity, leadership is responsible for communicating this policy to our stakeholders, as well as for its effective implementation. All Plug Power employees, suppliers and contractors are expected to uphold this policy and adhere to relevant company EHS policies, procedures and requirements.

Climate Change Policy

Climate change is a serious environmental, social and economic threat that calls for immediate and collaborative action among all sectors of society. Plug Power acknowledges its role in addressing this global issue and is committed to minimizing its greenhouse gas (GHG) emissions by:

Taking actions to measure, track, reduce and report our climate footprint, which includes direct and indirect emissions resulting from our operations and our value chain by subscribing to the principles of the Task Force on Climate-related Financial Disclosures (TCFD);

Determining appropriate targets for reducing GHG emissions for comparable companies;

Determining appropriate targets for total water consumption;

Identifying the risks of its business activities on the environment;

Adopting a hazardous waste policy;

Determining the portion of energy derived from renewable and non-renewable sources;

Considering factors in product design and development that enhance energy efficiency and promote smarter energy use;

Administering a commute alternatives program that provides employees incentives to commute by carpool, bike and transit where feasible; and

Partnering with organizations that are working to address climate change.

Plug Power leadership takes ownership and monitors our performance in reducing GHG emissions and mitigating climate change by factoring this into our organization’s strategies.

Sustainability and Safety

We are committed to providing a safe and healthfulhealthy working environment for our employees, which includes maintainingfocusing on being in compliance with all applicable federal, state, and local laws, rules, and regulations relating to workplace safety and conditions. We strive for zero work-related injuries or illnesses. ToAs part of our commitment, we hired a Vice President of Environmental Health & Safety and expanded our global environmental health and safety leadership. We believe that end,having this leadership team in place alongside other experienced environmental health and safety professionals enables us to foster a culture of safety excellence and create an environment where our team is accountable for their own safety and the safety of others. We have also recently deployed an environmental health and safety software management which we plan to use to report, notify and track inspections, job safety analyses and incidents, if any. In addition, we purchased a learning management system with a suite of several hundred environmental health and safety courses, which has allowed for a one-stop location where employees can access all available environmental, health and safety trainings in a multitude of languages. We have also implemented written programs, includingergonomic solutions to assist in increasing productivity and decreasing muscle fatigue and the severity of work-related musculoskeletal system diseases.

Contacting the Board of Directors

Cautionary Note Regarding Forward-Looking Statements

This Proxy Statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. You can identify forward-looking statements by words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” “estimate,” “predict,” “potential,” “continue” or other similar expressions. Actual results may differ from those set forth in the forward-looking statements due to a variety of factors, including those contained in the Company’s Annual Report on Form 10-K for the year ended December

Executive Officers | | | Age | | | Position | |

Andrew J. Marsh | | 67 | | | President, Chief Executive Officer and Director | | |

Paul B. Middleton | | 55 | | Chief Financial Officer and Executive Vice President | | ||

| |||||||

Gerard L. Conway, Jr. | | 58 | | | General Counsel, Corporate Secretary and | | |

| |||||||

Jose Luis Crespo | | 53 | | | General Manager, Applications and Executive Vice President | | |

Martin D. Hull | | 55 | | | Corporate Controller and Chief Accounting Officer | | |

| David Mindnich | | | 45 | | | Executive Vice President, Global Manufacturing | |

| Keith C. Schmid | | | 60 | | | Executive Vice President, Special Projects | |

| Sanjay K. Shrestha | | | 49 | | | General Manager, Energy Solutions, Chief Strategy Officer, and Executive Vice President | |

Plug Powerthe Company as Senior Vice President and Chief Financial Officer and Executive Vice President in 2014. Prior to Plug Power, Mr. Middleton worked at Rogers Corp., a global manufacturer and distributor of specialty polymer composite materials and components, from 2001 to 2014. During his tenure at Rogers Corp., Mr. Middleton served in many senior financial leadership roles, including Corporate Controller and Principal Accounting Officer, Treasurer and Interim Chief Financial Officer. Prior to Rogers Corp., Mr. Middleton managed all financial administration for the tools division of Coopers Industries from 1997 to 2001. Mr. Middleton holds a Master of Science in Accounting and a BBA from the University of Central Florida. Additionally, he is a Certified Public Accountant.

Gerard L. Conway, Jr. has served as General Counsel and Corporate Secretary of Plug Power since September 2004 and, since March 2009, has also served as Senior Vice President of Plug Power. In that capacity, Mr. Conway is responsible for advising the Company on legal issues such as corporate law, securities, contracts, strategic alliances and intellectual property. He also serves as the Compliance Officer for securities matters affecting the Company. During his tenure at Plug Power, Mr. Conway served as Vice President of Government Relations from 2005 to June 2008 and in that capacity he advocated on energy issues, policies, legislation and regulations on the state, federal, national and international levels on behalf of the Company and the alternative energy sector. Prior to his appointment to his current position, Mr. Conway served as Associate General Counsel and Director of Government Relations for the Company beginning in July 2000. Prior to joining Plug Power, Mr. Conway spent four years as an Associate with Featherstonhaugh, Conway, Wiley & Clyne, LLP, where he concentrated in government relations, business and corporate law. Mr. Conway has more than 20 years of experience in general business, corporate real estate and government relations. Mr. Conway holds a Bachelor of Arts degree in English and Philosophy from Colgate University and a Juris Doctorate from Boston University School of Law.

Sanjay K. Shresthajoined the Company as Chief Strategy Officer and Executive Vice President in 2019.April 2019, and was appointed as General Manager, Energy Solutions in January 2021. Prior to joining Plug Power, Mr. Shrestha served as the Chief Investment Officer of Sky Solar Holdings, which owned and operated solar projects in Japan, Europe and the Americas, and President of Sky Capital America, which owned and operated solar projects in North and South America, since 2015. Under his leadership, Sky Capital America built and acquired over 100MW of operating solar assets and secured a pipeline over 100MW. He also sourced various types of financing solutions to support this growth, including project debt, construction equity and long-term equity. Before global solar IPP,Sky Capital America, he led the renewables investment banking effort at FBR Capital Markets (now known as B. Riley Financial, Inc.) since 2013. During 2014, and under his leadership, the

Jose Luis Crespo joined the Company as Vice President of Business and International Sales in 2014. He was promoted to Vice President of Global Sales in January of 2015 and in 2016 he was also named General Manager for Hypulsion, the Company’s wholly owned European subsidiary. Prior to joining the Company, Mr. Crespo served as Vice President of International Value Stream at Smiths Power, a supplier of power distribution, conditioning, protection and monitoring solutions for data centers, wireless communications and other critical or high-value electrical systems, from 2009 to 2013. Mr. Crespo holds a Master in Business Administration from the University of Phoenix and a degree in Telecommunications Engineering from the Engineering University of Madrid, Spain.

Martin D. Hull joined Plug Power as Corporate Controller and Chief Accounting Officer in April 2015. Prior to that, he was a principal and director with the certified public accounting firm of Marvin and Company, P.C. from November 2012 to March 2015. Prior to that, Mr. Hull was with KPMG LLP, serving as partner from October 2004 to September 2012, and has a total of 24 years of public accounting experience. Mr. Hull holds a Bachelor of Business Administration with a concentration in Accounting from the University of Notre Dame.

| | | | With Plug Power Since: | |

| Andrew J. Marsh, our President and Chief Executive Officer and a Director | | | 2008 | |

| Paul B. Middleton, our Chief Financial Officer and Executive Vice President | | | 2014 | |

| Gerard L. Conway, Jr., our General Counsel, Corporate Secretary, and Executive Vice President | | | 2000 | |

| Jose Luis Crespo, our General Manager, Applications and Executive Vice President | | | 2014 | |

| Dirk Ole Hoefelmann, our Former General Manager, Electrolyzers and Executive Vice President | | | 2021 | |

Keith Schmid, our Executive Vice President, Special Projects | | | 2013 | |

| Sanjay K. Shrestha, our General Manager, Energy Solutions, Chief Strategy Officer, and Executive Vice President | | | 2019 | |

Andrew J. Marsh, our President and Chief Executive Officer and a Director;

Paul B. Middleton, our Chief Financial Officer and Senior Vice President;

Sanjay K. Shrestha, our Chief Strategy Officer;

Keith C. Schmid, our Chief Operating Officer and Senior Vice President; and

Jose Luis Crespo, our Vice President-Global Sales.

While the discussion in this section is focused on our named executive officers, many of our executive compensation programs apply broadly across our executive ranks. The following discussion should be read together with the compensation tables and related disclosures set forth below.

that follow.

Our Response to the Covid-19 Pandemic

Like all companies, Plug Power was impacted by the Covid-19 pandemic. We rose to the challenge and our response is reflective of our culture and our commitment to our employees, to our customers and to society. Below are a few highlights:

We prioritized the health and wellbeing of our employees and their families while continuing to deliver for our customers.

As restrictions and shutdowns were announced in countries around the world, we implemented new and imaginative ways for our employees to work at our facilities and remotely.

We enabled our employees to remain focused on delivering for our customers by providing personal and financial “peace of mind” by assuring job security and not implementing salary reductions or furloughs.

Our world-class engineers built ventilator prototypes to address the severe country-wide shortages.

We deployed members of our engineering, manufacturing and logistics teams to design and 3D print thousands of face shields that were donated to healthcare facilities and communities.

Our resourceful buyers sourced and coordinated personal protective equipment (PPE) distribution to hospitals.

We facilitated the critical delivery operations of our customers providing essential services in the food, retail and cleaning supplies industries.

We engaged in corporate philanthropy by making donations to several charitable organizations, including The United Way and The No Neighbor Hungry Campaign.

The Covid-19 pandemic has highlighted the importance of innovative technology-driven solutions and imaginative human capital management to address an unprecedented crisis; it has also revealed just how interconnected we are as a society. We are proud of our Company’s response, and we are grateful for the extraordinary contribution of our employees to the success of Plug Power.

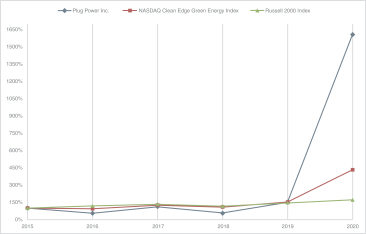

![[MISSING IMAGE: lc_plug-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/lc_plug-4c.jpg)

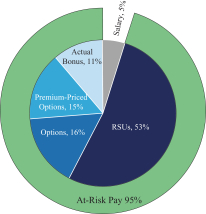

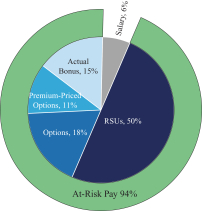

![[MISSING IMAGE: fc_anncash-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/fc_anncash-4c.jpg)

![[MISSING IMAGE: bc_totalsharereturn-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/bc_totalsharereturn-4c.jpg)

![[MISSING IMAGE: bc_netincome-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/bc_netincome-4c.jpg)

![[MISSING IMAGE: bc_revenue-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/bc_revenue-4c.jpg)

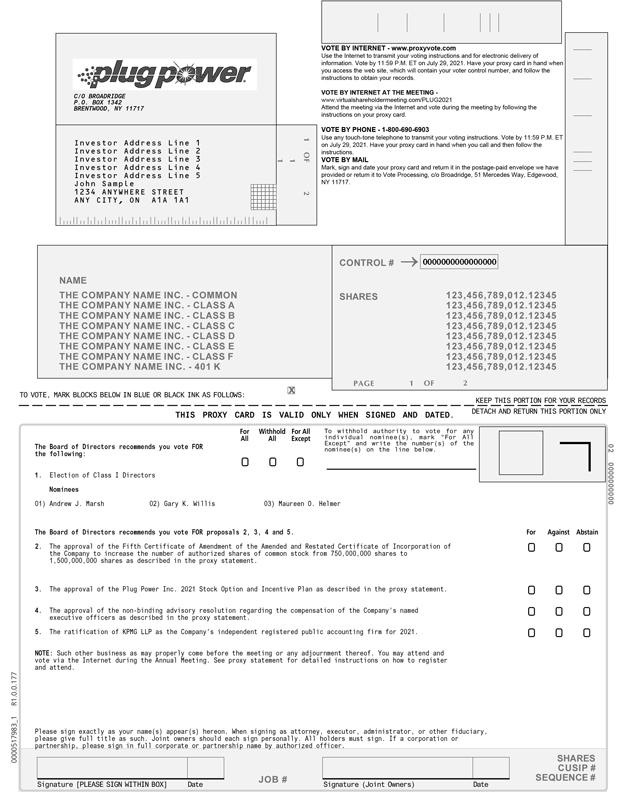

![[MISSING IMAGE: px_plugpowerproxy1page01-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/px_plugpowerproxy1page01-bw.jpg)

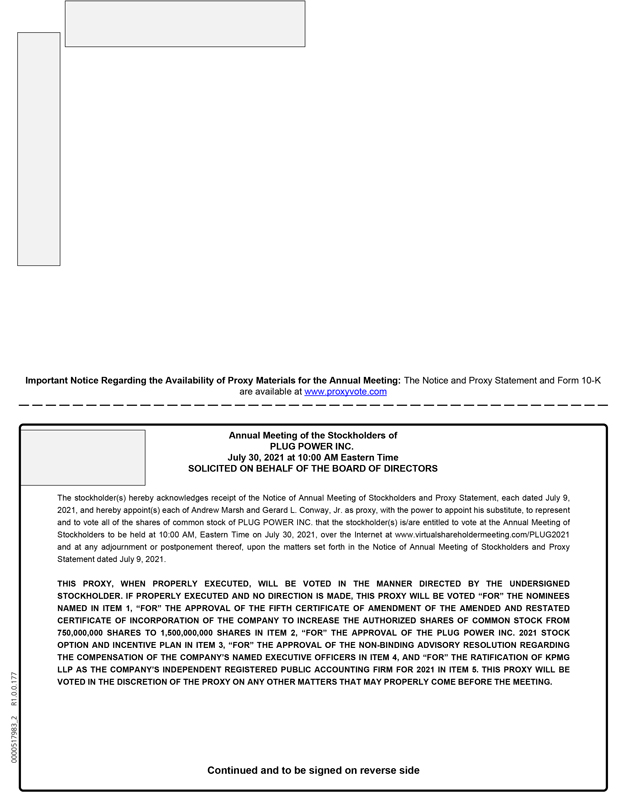

![[MISSING IMAGE: px_plugpowerproxy1page02-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-061040/px_plugpowerproxy1page02-bw.jpg)